When we think about wars, the first things that often come to mind are the battles, the bravery, and the profound human stories. But beyond the headlines and history books, wars have a quieter, yet powerful impact—one that hits us right where it hurts: our wallets. In this article, we’ll explore how prolonged conflicts ripple through the economy, affecting everything from government spending and inflation to the prices we pay at the store. Whether you’re a history buff, a curious consumer, or just looking to understand how global events shape everyday life, stick around—this breakdown of war’s economic fallout might just change the way you see those faraway conflicts.

Table of Contents

- The Hidden Costs of Prolonged Conflicts on Everyday Life

- How War Spending Drains Public Resources and Hurts Growth

- The Ripple Effect on Jobs, Prices, and Personal Finances

- Smart Strategies to Protect Your Wallet Amid Economic Uncertainty

- In Summary

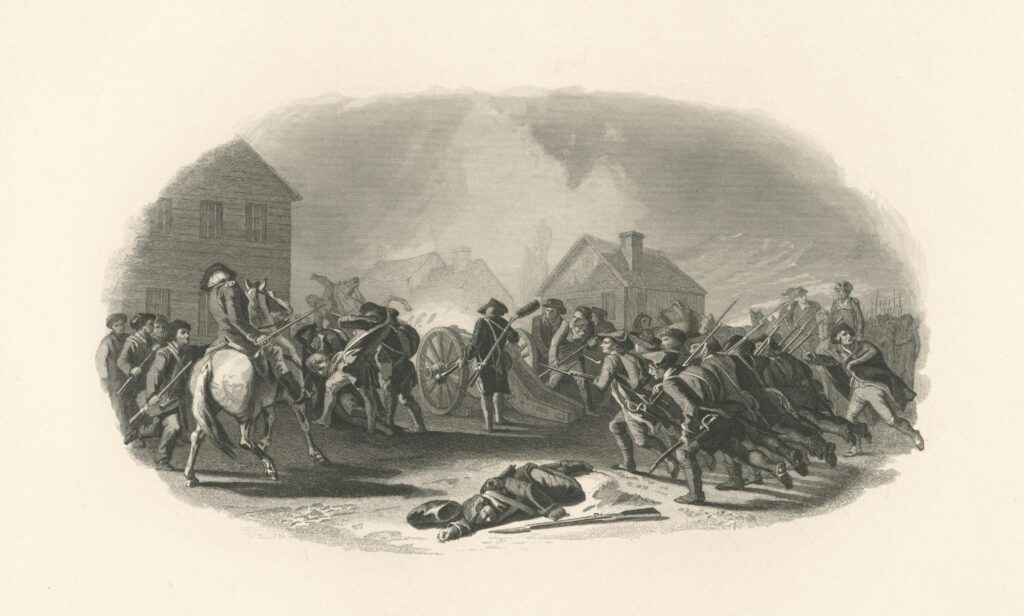

The Hidden Costs of Prolonged Conflicts on Everyday Life

When conflicts drag on, the ripple effects squeeze everyday budgets in ways that many people don’t immediately notice. Government spending often shifts dramatically towards defense, funneling money away from essential services like education, healthcare, and infrastructure. This reallocation means fewer resources for public programs that support communities, leading to increased out-of-pocket expenses for families. Add in rising inflation driven by uncertainty and disrupted supply chains, and suddenly, the cost of groceries, fuel, and housing can outpace wage growth, putting strain on household finances.

Beyond direct government spending, wars also distort global markets and investment confidence. Small businesses face higher borrowing costs as interest rates climb in response to economic instability, while consumer confidence dips, lowering demand and job opportunities. Families may notice these changes through:

- Higher prices on basic goods as production and transportation become more expensive

- Job insecurity in industries tied to international trade or affected by sanctions

- Increased taxes introduced to cover war expenses, diminishing disposable income

- Slower economic growth resulting in fewer opportunities for wage increases or promotions

Ultimately, the financial burdens born from long wars seep into everyday wallets, often hidden behind broader economic trends but deeply felt in daily life.

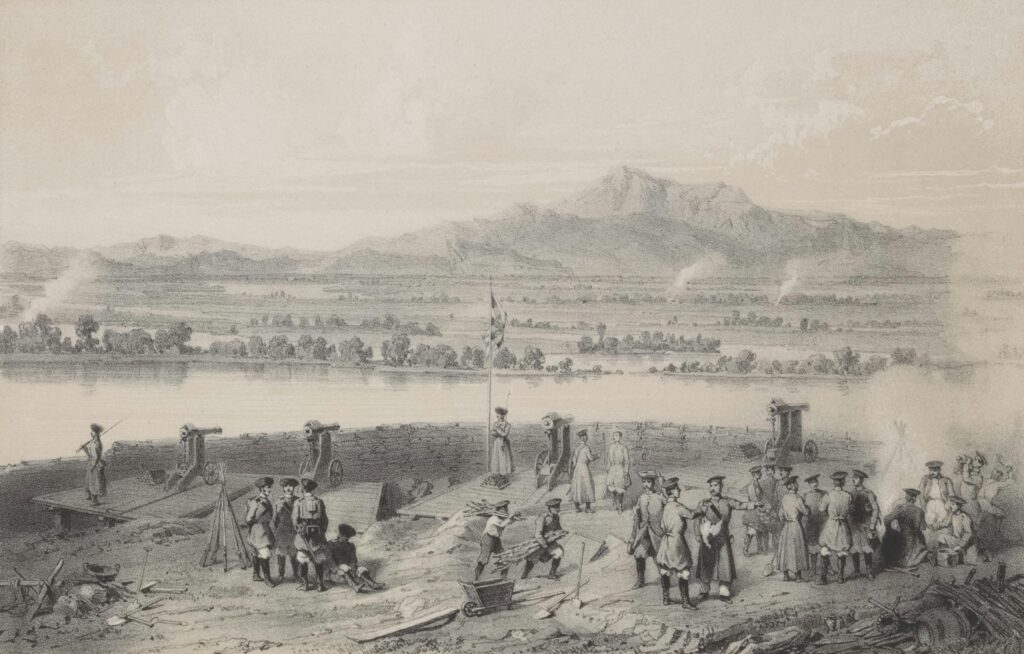

How War Spending Drains Public Resources and Hurts Growth

When a nation pours massive funds into military conflicts, it limits the budget available for vital public services like education, healthcare, and infrastructure. This redirection creates a tangible squeeze on community well-being, as schools deteriorate, hospitals become underfunded, and roads fall into disrepair. In the long run, such neglected sectors reduce overall productivity and quality of life. Inflation often follows, further straining household budgets and slowing personal savings. It’s a ripple effect that touches every corner of society, silently shrinking economic potential while the military budget balloons.

Moreover, war spending often crowds out investments that fuel innovation and economic growth. Instead of channeling resources into research and development or small business support, funds are diverted to sustain military campaigns. This not only reduces job opportunities in civilian industries but also stunts technological progress that could otherwise boost competitiveness. The government’s focus shifts, prioritizing short-term conflict needs over sustainable growth strategies. In essence, the economy becomes less resilient, caught in a cycle where critical public services suffer and future prosperity is compromised.

The Ripple Effect on Jobs, Prices, and Personal Finances

When conflicts stretch on, the economic aftershocks aren’t confined to distant battlefields—they reach deep into everyday lives. Jobs become precarious as companies face increased costs and uncertain markets, leading many to freeze hiring or slash positions entirely. Industries tied closely to wartime demands might see temporary booms, but these are often short-lived and followed by layoffs once military needs dwindle. On the flip side, sectors like tourism and retail frequently experience downturns as consumer confidence drops and spending tightens. These shifts create a patchwork of winners and losers that ripple through communities, sparking increased unemployment and underemployment for months or even years.

Prices don’t stay stable either; inflation often sneaks in as governments boost military spending, frequently financed by borrowing or printing money. Everyday essentials like fuel, food, and household goods become more expensive, stretching budgets thin. For many families, this means making tough choices—cutting back on non-essentials, dipping into savings, or piling on debt to keep up. Personal finances face pressure from multiple angles:

- Higher interest rates on loans and credit cards as central banks try to control inflation

- Reduced availability of affordable housing due to fluctuating construction costs

- Lower disposable income because of rising commuting and utility expenses

Understanding these economic shocks helps highlight the urgent need for policies that not only support defense but also protect the financial well-being of citizens at home.

Smart Strategies to Protect Your Wallet Amid Economic Uncertainty

When the economy feels shaky, especially during times of prolonged conflict, taking proactive steps to safeguard your finances is more important than ever. Start by diversifying your income streams. Relying solely on a single paycheck can leave you vulnerable to the ripple effects of economic downturns. Consider freelance work, side hustles, or passive income opportunities like dividend stocks or rental properties. Additionally, maintaining an emergency fund that covers at least 3-6 months of living expenses can act as a crucial buffer against unexpected financial shocks.

Smart budgeting becomes essential during these uncertain times. Focus on identifying and cutting non-essential expenses without sacrificing your quality of life. Simple habits such as meal prepping, using public transportation, and negotiating better deals on bills can add up over time. Keep an eye on inflationary pressures caused by conflicts by being mindful of price changes and adjusting your spending habits accordingly. Here’s a quick checklist to help you stay financially agile:

- Track monthly expenses with apps or spreadsheets

- Prioritize debt repayment, starting with high-interest loans

- Shop with a list to avoid impulse buying

- Explore community resources or discounts

- Regularly review and adjust your financial goals

In Summary

Thanks for sticking with me through this deep dive into how wars strain our wallets in ways we might not always see coming. While the headlines often focus on battles and politics, the economic ripple effects touch all of us—from rising taxes and inflation to shifts in job markets and government spending priorities. Understanding these impacts helps us make sense of why peace and stability matter not just for global harmony, but for our personal financial health too. Here’s to hoping for smarter choices and more peaceful days ahead—both for our economies and our everyday lives. Until next time, stay curious and financially savvy!