War is often talked about in terms of battles, borders, and politics—but have you ever stopped to think about how those prolonged conflicts quietly affect our everyday finances? From the price at the pump to government budgets, wars leave a trail of economic ripples that reach far beyond the battlefield. In this blog post, we’ll break down exactly how long wars hit our wallets, exploring the hidden costs, surprising consequences, and what it all means for you and me. Ready to uncover the real price of war? Let’s dive in!

Table of Contents

- How Wars Drain National Budgets and What That Means for You

- The Ripple Effect on Everyday Prices and Household Finances

- Unpacking Historical Examples to Understand War’s Economic Impact

- Smart Strategies for Protecting Your Wallet During Times of Conflict

- To Conclude

How Wars Drain National Budgets and What That Means for You

When countries are caught in prolonged conflicts, the financial toll extends far beyond the battlefield. A considerable chunk of the national budget gets diverted towards military expenditures, from buying weapons to funding soldiers’ salaries and logistical support. This sudden shift means less money available for crucial public services like education, healthcare, and infrastructure. Citizens often see the effects in their daily lives, such as higher taxes, reduced social benefits, or delayed public projects, which can hamper long-term national development.

Wars also spark indirect economic consequences that ripple through communities. Inflation tends to rise as governments print more money to cover war costs, and foreign investment often dries up due to instability. Here’s what you might notice when the budget takes a hit from conflict:

- Increased public debt leading to austerity measures

- Job losses in sectors unrelated to defense

- Reduced funding for innovation and research

- Greater economic inequality as resources get unevenly distributed

All these factors combined mean that the long shadow of war lingers in wallets long after the fighting ends.

The Ripple Effect on Everyday Prices and Household Finances

When conflicts drag on, the economic tremors extend far beyond the battlefield, subtly infiltrating daily life and household budgets. Prices of essential goods—like food, fuel, and clothing—often spike due to disrupted supply chains, increased production costs, and market uncertainties. For families trying to stretch every dollar, these increases can feel like a stealthy tax, limiting spending power and forcing tough choices between necessities and extras. Inflation, sparked or exacerbated by war spending, drains savings and shrinks purchasing power, turning what once felt affordable into a strain on monthly finances.

Moreover, long-term wars can create a cascading effect on employment and wages. Job markets may tighten as resources are diverted toward defense industries, while other sectors lag behind. Households face indirect challenges such as:

- Higher borrowing costs: Interest rates may rise as governments seek to finance military spending, making mortgages and loans pricier.

- Reduced public services: Budget reallocations can lead to cuts in community programs or social benefits that many families rely on.

- Energy price volatility: Conflicts often disrupt oil and gas supplies, stoking fuel price swings that ripple through transportation and heating bills.

These complex, interconnected price shifts mean that the financial impact of extended wars is rarely immediate but steadily accumulates, reshaping everyday economic realities for millions of households worldwide.

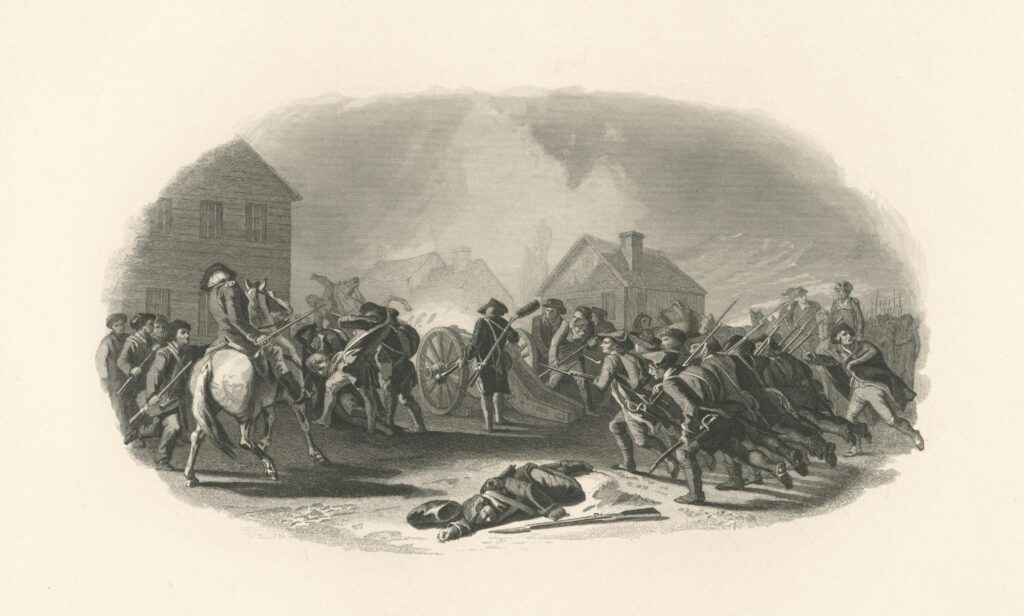

Unpacking Historical Examples to Understand War’s Economic Impact

Throughout history, wars have dramatically reshaped economies in ways that ripple far beyond the battlefield. Take, for instance, the aftermath of World War II: while the immediate destruction was staggering, many countries found their industries invigorated by wartime production. The U.S., in particular, saw a boom driven by government spending, creating millions of jobs and catalyzing technological innovation. Yet, this economic surge was accompanied by inflationary pressures and significant shifts in global trade balances, showing how complex the economic aftermath can be. In contrast, prolonged conflicts like the Vietnam War strained financial resources, leading to budget deficits and undermining public confidence, which took years to rebuild.

We can learn a lot by breaking down common economic consequences that history reveals during and after prolonged conflicts:

- Massive government debt: Wars often come with enormous borrowing, leaving a legacy of repayment struggles.

- Labor market disruption: Millions of people either enlisted or displaced, causing shortages and changing workforce dynamics.

- Inflation spikes: Increased spending combined with supply chain shocks pushes prices upward.

- Industrial shifts: Some sectors boom with military contracts while others face neglect or destruction.

Smart Strategies for Protecting Your Wallet During Times of Conflict

When conflicts strike, the ripple effect can quickly reach your personal finances, but proactive measures can make all the difference. Start by diversifying your savings — instead of locking everything into one account or currency, spread your assets across different types of investments such as bonds, precious metals, or foreign currencies. This approach helps cushion the blow when inflation spikes or exchange rates fluctuate unpredictably. Additionally, keeping an emergency fund that covers at least three to six months of expenses can provide a vital safety net during uncertain economic times.

Another valuable tactic is to limit discretionary spending and focus on essentials to preserve cash flow. Prioritize budgeting tools or apps that track your spending habits to stay mindful of where your money goes. It’s also wise to stay informed about shifting market trends and government policies, as they can signal upcoming economic shifts. Lastly, consider sharpening your skills or obtaining certifications to make your career more resilient—economic downturns often impact job security, so being adaptable is key.

- Keep a diversified portfolio to reduce risk.

- Maintain an emergency fund for unexpected costs.

- Cut unnecessary expenses and track your budget.

- Stay updated on economic and political developments.

- Invest in personal growth to improve job security.

To Conclude

Thanks for sticking with me through this deep dive into how wars ripple through our wallets. While the headlines might focus on battles and politics, the economic fallout touches all of us in ways big and small—whether it’s higher prices at the grocery store or shifts in job markets. Understanding these impacts helps us see the true cost of conflict beyond just the battlefield. Here’s hoping for more peace and prosperity ahead, for our economies and our everyday lives alike. Until next time, stay curious and keep asking the tough questions!